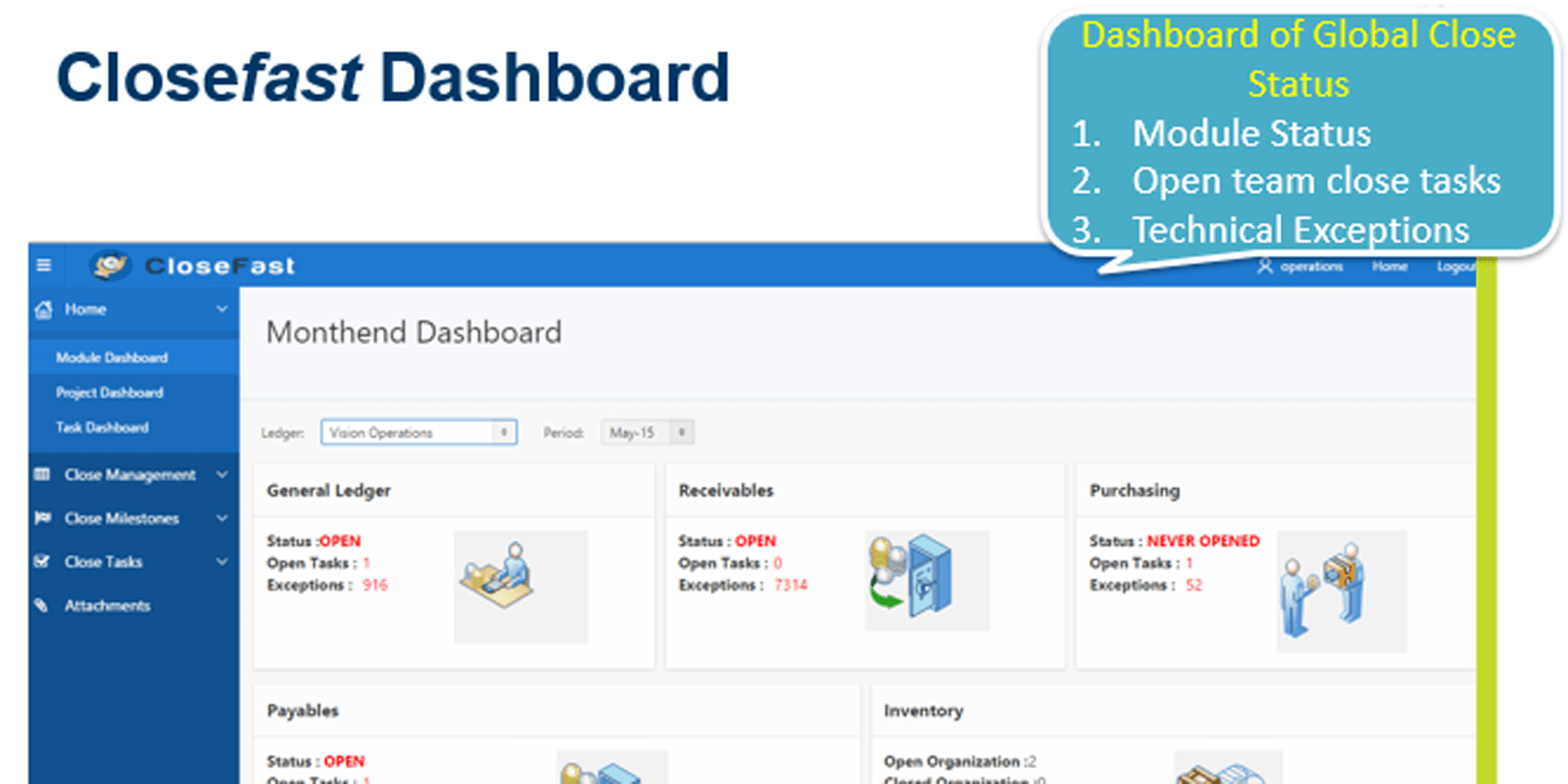

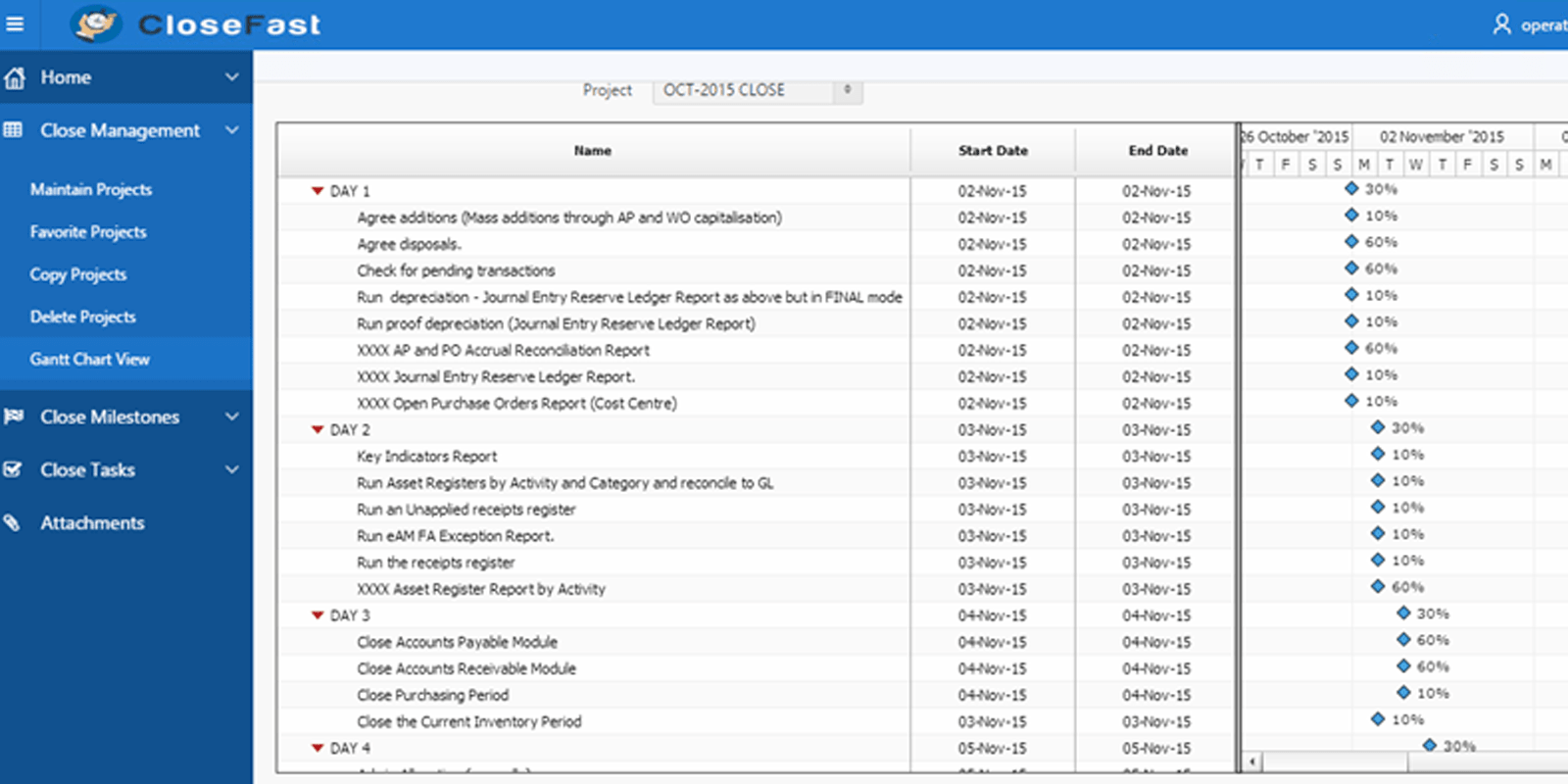

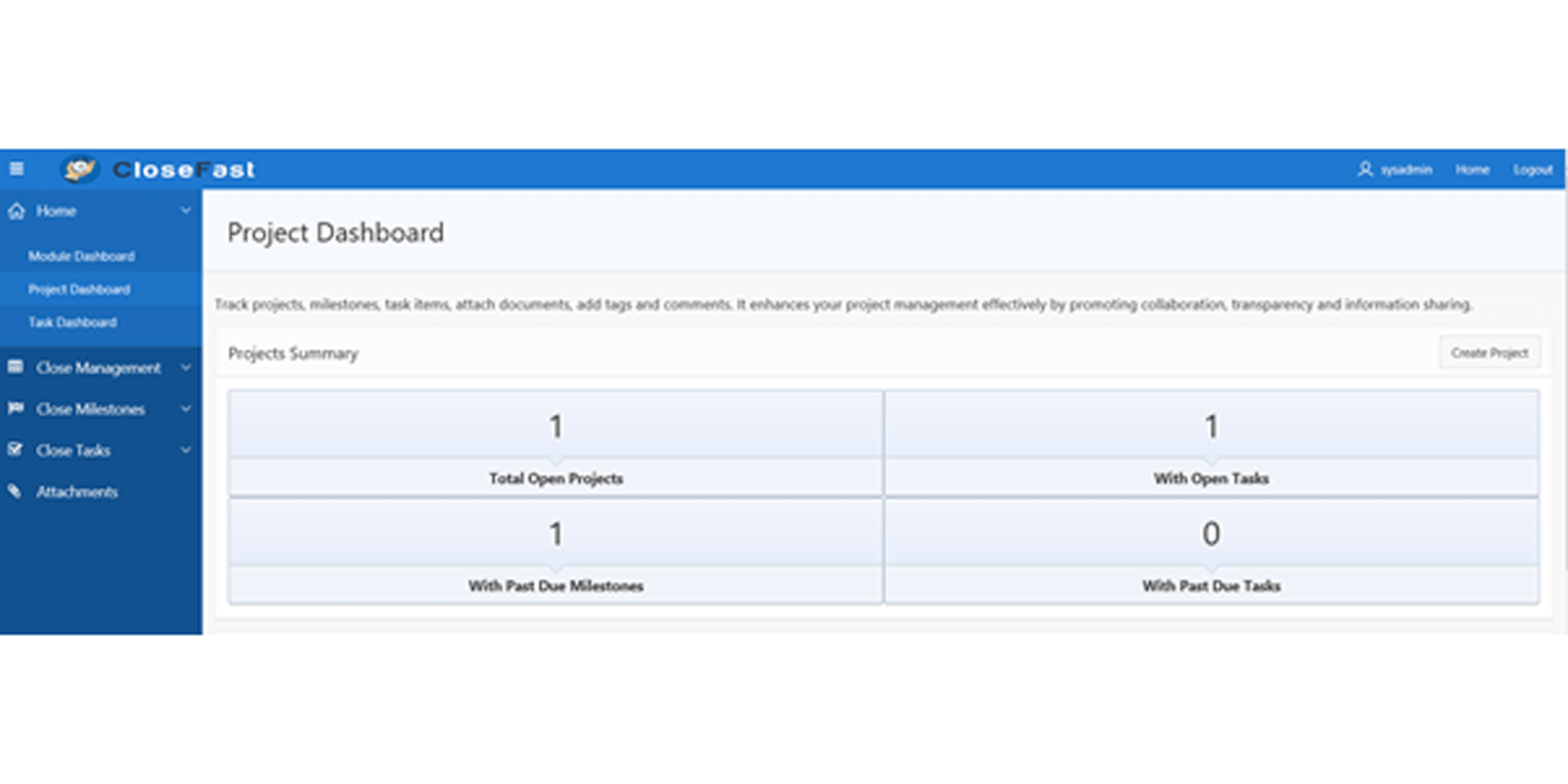

Many firms struggle with the financial closing cycle because a complex series of tasks must be executed on time and in the correct sequence to meet reporting deadlines. Typical closing cycles involve time-consuming manual tasks, such as journal entries, accruals, intercompany reconciliations and the gathering of financial data from across different systems for consolidation and validation for final report production. Standardizing the closing cycle into a series of repeatable process steps and managing those steps in accordance with best practices and a tightly controlled schedule is key to achieving superior financial close performance. Also, the IT department lacks the visibility of potential roadblocks across various modules. Providing greater visibility across modules, entities and ledgers will speed-up the close process.

BUSINESS BENEFITS

A rapid close through continuously improving close schedule and proactive month-end exceptions Increased efficiency and greater control through KPI reporting and oversight Improved productivity through improved coordination and collaboration Rapid time to deployment with simple configuration and powerful administration tools

This was selected by OAUG to present at COLLABORATE'16 Conference